In This Article

- Overview of the Supreme Court Ruling

- Eligibility for Compensation

- Checking Your Car Finance Contract

- Understanding Commission and Informed Consent

- Next Steps for Potential Claimants

- Estimating Compensation Amounts

Key Takeaways

- Millions of car owners who used finance deals in the past 18 years may be eligible for compensation due to undisclosed commissions paid to dealers, as ruled by the Supreme Court.

- Consumers with discretionary commission arrangements (DCAs) in their car loans, banned in 2021, are particularly likely to qualify for compensation if they were overcharged.

- Compensation eligibility hinges on whether commission details were clearly disclosed in contracts, with unclear or hidden terms potentially qualifying claimants.

- The Financial Conduct Authority (FCA) is developing a compensation scheme, with payouts expected in 2026, and advises against using fee-based claims companies.

- Compensation amounts are likely tied to overcharged interest, with most claims estimated under £950, including 3% annual interest, and multiple payouts possible for those with multiple eligible loans.

Millions of car owners who utilized finance to purchase vehicles in the past 18 years may be entitled to compensation following a recent Supreme Court ruling. The court decision centered on hidden commissions that lenders paid to dealers, which could have resulted in the mis-selling of finance to consumers.

The ruling does not guarantee immediate payouts, and consumers are advised against using claims companies that promise to expedite the process for a fee. Instead, individuals should consider the following steps to determine their eligibility for compensation.

Am I Eligible for Compensation?

Most car purchases involve motor finance, where buyers borrow money and repay it in installments over time. Car dealers typically receive a commission for arranging these loans.

The Supreme Court ruled that while many commission payments were legal, the failure to disclose these charges properly could be considered unfair and thus unlawful. The key factor is whether customers were treated fairly, though the Financial Conduct Authority (FCA) is still defining what constitutes fair treatment.

One group likely to be eligible are those who took out car loans with discretionary commission arrangements (DCAs), which were banned in 2021. These arrangements allowed dealers to charge higher interest rates and earn a percentage as commission. Customers who were overcharged under DCAs may have a valid claim.

Checking Your Contract

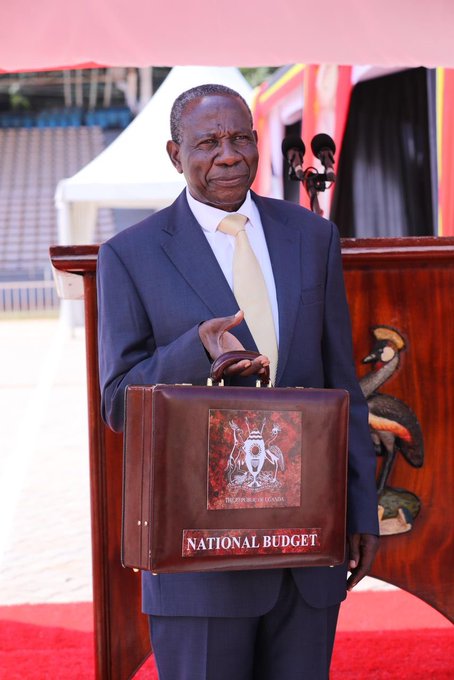

If you still have your car finance contract, review the terms and conditions to check for commission details. The Supreme Court's test case involved Marcus Johnson, who was entitled to compensation because 55% of his interest payments went to commission, which the judge deemed unreasonable.

Anyone paying a similar level of commission is likely eligible for compensation, but the exact threshold for what constitutes fair commission rates remains to be determined.

Understanding the Small Print

The debate around compensation also involves whether customers gave "informed consent" for commission payments. While the details should be in the contract, many people do not read the fine print, especially under pressure in a car showroom.

The Supreme Court ruled that key contract elements were not prominently displayed. If your contract lacked clear, highlighted information about commission arrangements, you might be eligible for compensation.

Next Steps for Potential Claimants

The FCA is establishing a compensation scheme, with a consultation expected in October and payments anticipated in 2026. In the meantime, consumers can write to their lenders to establish the facts of their case. Lenders must acknowledge complaints within eight weeks, potentially providing an indication of eligibility for redress.

Consumer groups and the FCA advise against using claims companies, as they cannot process claims until the FCA scheme is set up and will take a portion of any compensation.

Estimating Compensation Amounts

The exact compensation amounts are not yet clear, but they are likely to be related to the amount charged. Most claims are expected to be under £950, including around 3% in annual interest. Individuals who have taken out multiple car finance deals in recent decades could be eligible for more than one payout.

Comments (0)

Leave a Comment

Be the first to comment on this article!